The global content delivery network market size was valued at USD 15.47 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 23.0% from 2022 to 2030. The COVID-19 pandemic has directly affected the market as the content delivery network vendors rely on several economic factors, such as vibrant financial markets, the flow of liquidity, and capital from financial institutes, for their revenue. Despite these factors, the CDN market is expected to witness steady growth over the forecast period due to the increasing volumes of data being exchanged on the Internet in line with the continuous rollout of high-speed networks.

Prominent Content Delivery Network Market Drivers

Increased Preference for CDN Services for Dynamic Content Requirements to Stimulate Uptake

In terms of digital content distribution, content delivery networks are highly competitive in terms of service quality. As a result, market participants use edge servers for localized caching, necessitating dynamic security.

Software-defined networking (SDN) and network function virtualization (NFV) technologies are rapidly gaining traction, allowing for high-performance services without the need for massively distributed infrastructure, resulting in significant opportunities for large-scale cloud systems.

Content delivery networks not only improve video content and streaming speed and quality, but they also provide high levels of dependable security and superior scalability due to lower data storage costs and content management outsourcing.

Key Challenges hindering Content Delivery Network Market

The Shift of Key Players to In-House CDN Infrastructure and Network Connectivity Issues is Impeding CDN Demand

Some major organizations are shifting their focus away from third-party CDN services and toward building their own content delivery network tailored to their specific requirements. Viruses and cyberattacks are becoming more common as more people use video streaming services to watch movies and advertise. The absence of appropriate standards and procedures for discovering and regulating video content may stymie market growth.

High-cost technology, insufficient connectivity, and the need for high-quality service, as well as concerns about data security and privacy, are expected to constrain the industry. Technical difficulties in live video streaming, complex architecture, and issues with service quality may stymie market growth.

Country-wise Analysis

How will the U.S perform in the Global Market for Content Delivery Network?

Cloud-Based Service Adoption is growing, which is Driving Market Expansion

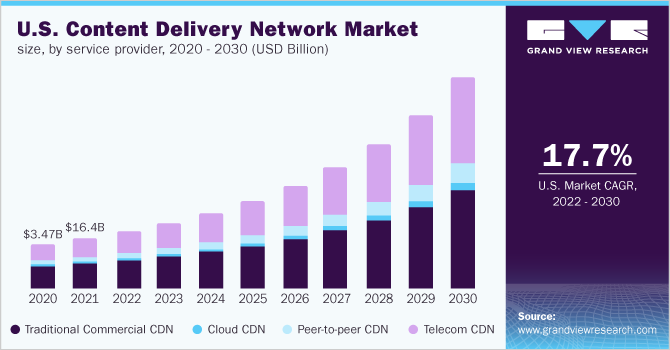

As per Fact.MR’s analysis, the content delivery network market in the United States is expanding steadily as a result of the widespread adoption of smart devices, higher adoption rates by SMEs, and widespread internet penetration. The country is expected to flourish at a 12% CAGR from 2022 to 2032.

Furthermore, rising acceptance of cloud-based services, deployment of high-speed data networks, and rising smartphone demand are expected to drive market expansion in the United States. An increase in leisure spending is another key factor driving the use of content delivery network solutions in the country.

Will China be the Kingpin of the Content Delivery Network Landscape across Asia Pacific? Increasing CDN Solution Development Initiatives to Support Market Growth

China is a significant and rapidly expanding market for content delivery networks. The rapid spread of the e- Commerce sector, as well as the media and entertainment industries, can be attributed to the growth. Key players are heavily investing in high-speed network installations, making the deployment of content delivery networks in the country critical.

The use of content delivery network solutions is expected to increase as a result of several government initiatives that have enabled quick and secure data delivery management. According to Fact. MR, the content delivery network market in China is poised to grow at a CAGR of 12.1% until 2032, reaching US$ 4.4 Billion.

Category-wise Analysis

By Service Provider, which Category of Content Delivery Network will dominate?

Traditional CDN Service Providers Offer a Variety of Solutions to Fuel Market Revenue

According to Fact. MR’s estimates, content delivery network services are primarily provided by telecom CDNs or traditional CDNs. Traditional CDN service providers have a sizable market share. This pattern is unlikely to shift during the forecast period.

The sector’s dominance can be attributed to a broader range of services offered, such as content acceleration, network optimization, and media delivery, among others. Traditional CDN service providers are introducing solutions for meaningful content and network delivery optimization in response to the surge in global data consumption. Which Application is expected to abound for the Content Delivery Network Software Industry?

There is an Increasing Demand for CDN Solutions to Ensure Latency-Free Media Distribution/Delivery Website caching, media distribution/delivery, and software distribution/delivery can all be accomplished through the use of content delivery networks. The content delivery network market is 55.1% dominated by media distribution/delivery. This expansion can be attributed largely to the recent surge in popularity of video streaming services and VOD subscriptions, which has fueled demand for content delivery and network operational optimization.

The demand for Smartphones and other smart and connected devices that can support digital media is expected to drive growth in the media distribution/delivery application segment. Customers in emerging economies have few options but to access data wherever and whenever they want, thanks to the ongoing deployment of high-speed network

Competitive Landscape

Content delivery network service providers are heavily focused on strategic partnerships within the industry and with end-user corporations in order to establish long-term revenue strategies and accelerate product development. Video-on-demand and video conferencing applications are creating significant opportunities for content delivery solution providers.

Key Developments in the Content Delivery Network Market:

• CloudFlare Inc. announced collaboration with the Internet Archive to improve the reliability of website operations for publishers, which will include users who do not use CloudFlare services. The collaboration will help to improve CloudFlare services while also providing more data to the Internet Archive.

• Limelight Networks, Inc., a leading provider of CDN services, announced the availability of GraphQL functionality for its LayerO by Limelight web application CDN in December 2021. This new feature strengthens Limelight’s position in the web application CDN market, particularly among web builders.

Key Companies & Market Share Insights

The key companies are undertaking several initiatives to expand their geographical reach and strengthen their foothold in the global market. Such initiatives include investments in R&D activities, mergers and acquisitions, new product launches, strategic collaborations and partnerships, and upgrades to the existing solutions. For instance, in December 2021, Limelight Networks, Inc., a leading provider of CDN services, announced the availability of GraphQL functionality for its Layer0 by Limelight web application CDN. This new functionality enhances Limelight’s presence in the web application CDN market, especially for web builders. Some of the prominent players operating in the global content delivery network market are:

- Akamai Technologies

- Amazon Web Services, Inc.

- International Business Machines Corp.

- Limelight Networks

- Verizon

- AT&T Intellectual Property

- Google LLC

- Microsoft

- CenturyLink

- Deutsche Telekom AG

- Tata Communications

- Fastly, Inc.

- Tencent Cloud

- Kingsoft Corporation, Ltd.

- Alibaba.com

Content Delivery Network Market Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 18.18 billion |

| Revenue forecast in 2030 | USD 95.37 billion |

| Growth rate | CAGR of 23.0% from 2022 to 2030 |

| Base year for estimation | 2021 |

| Historical data | 2017 – 2020 |

| Forecast period | 2022 – 2030 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2021 to 2030 |

| Report coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Segments covered | Content-type, solutions, service provider, end use, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil; Mexico |

| Key companies profiled | Akamai Technologies; Amazon Web Services, Inc.; International Business Machines Corp.; Limelight Networks; Verizon; AT&T Intellectual Property; Google LLC; Microsoft; CenturyLink; Deutsche Telekom AG; Tata Communications; Fastly, Inc.; Tencent Cloud; Kingsoft Corporation, Ltd.; Alibaba.com |

| Customization scope | Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

Recent Comments